From the printing press to the internet, technology has consistently democratized access to information, reshaping how we learn, share, and connect. Crypto is now bringing the same transformative power to the financial markets.

Crypto is a hyper-financialization tool. By breaking down barriers and hierarchies entrenched in TradFi, it accelerates the velocity of money and enables capital to flow freely across the financial stack. Yet, in its quest to rewrite the rules of finance, the industry often finds itself relearning the same fundamental lessons. This dynamic is apparent in the emergence of the “real-world assets” (RWAs; offchain assets that are tokenized and represented on blockchain networks), an asset class uniquely positioned at the intersection of traditional and decentralized financial markets.

While there are plenty of materials on individual RWA protocols, it was difficult to find a comprehensive resource that ties together the major trends, narratives, and lessons learned from this rapidly evolving sector. That’s what inspired me to write this piece. As DeFi stands on the cusp of another renaissance, I wanted to create a primer on RWAs that is easy to understand and fun to read.

This handbook is divided into two parts. The first part sets the stage by exploring the history of RWAs, charting their evolution and key milestones. The second part builds on this foundation, analyzing key lessons learned and offering predictions for the future.

As Winston Churchill famously observed, “The farther backward you can look, the farther forward you are likely to see.” The history of RWAs only spans a few years, but it offers crucial insights into both the fundamentals of the technology and its vast potential. I hope this handbook deepens your understanding of the genesis of RWAs and their future.

I. We’re Too Early

Tether pioneered the first RWA by accepting USD deposits and issuing USDT, creating a tokenized dollar in 2014. This fiat-backed tokenization model gained further momentum when Circle launched USDC in 2019. Today, USDT and USDC represent over $170 billion in market capitalization, demonstrating the impact these stablecoins have had on the crypto market.

However, asset tokenization beyond USD progressed at a much slower pace. There were a couple issues that hindered broader adoption.

The first hurdle was infrastructure. To bring these offchain assets onchain, the industry needed to develop sophisticated financial and legal structures and figure out a way to integrate them with smart contracts. Then came the bigger challenge: demand. Why would anyone buy tokenized assets onchain when traditional markets already offered these same products through established players that offered better service and lower costs?

These obstacles didn’t stop early crypto adopters from trying. And it wasn’t just their desire to create a decentralized utopia. They believed RWAs could solve DeFi’s core problems: price stability and scalability.

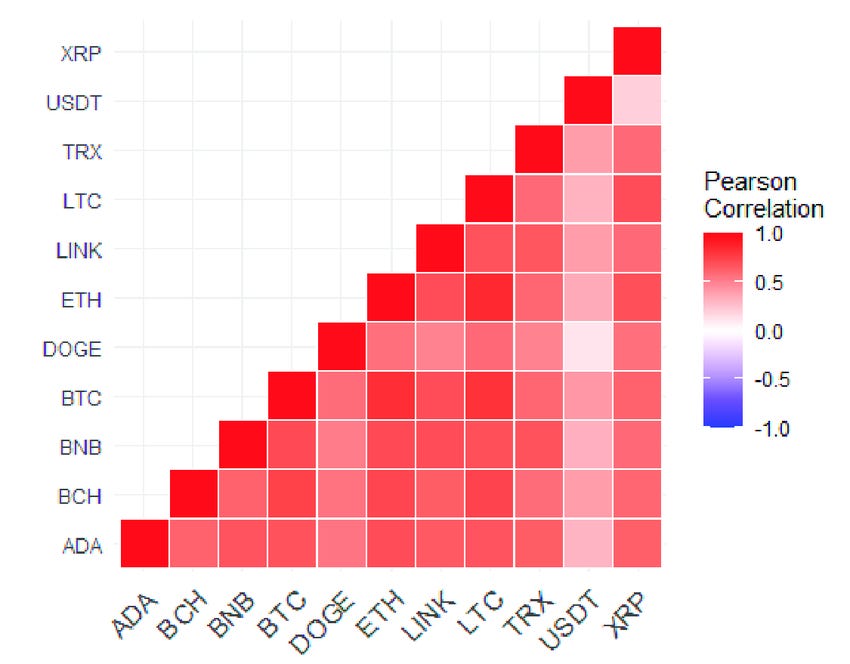

Figure 1: Correlation heat map for major cryptocurrencies (2017-2022)

Crypto markets have historically displayed high correlation, with most assets following Bitcoin’s bull-bear cycle. While this amplifies gains during bull markets, it also creates destructive spirals during downturns. RWAs offered a path to reducing this systemic risk by introducing assets that are less correlated with crypto’s volatility.

RWAs also presented an opportunity to expand DeFi beyond its crypto-native boundaries. At the time, DeFi had been largely confined to crypto transactions, which represented only a fraction of TradFi markets’ massive scale. By tokenizing and integrating even a small segment of RWAs into DeFi, the industry could tap into substantial liquidity and elevate itself to new heights.

II. The Changing Tides

While many were busy writing crypto’s obituary during the 2019 bear market, critical developments were unfolding behind the scenes. These foundational efforts would later catalyze the adoption of RWAs.

Centrifuge Paves the Way

Centrifuge emerged as a key player during this period. Driven by their vision to create a decentralized funding marketplace, the company launched Tinlake, a platform that enabled businesses to tokenize their assets and use them to secure crypto loans.

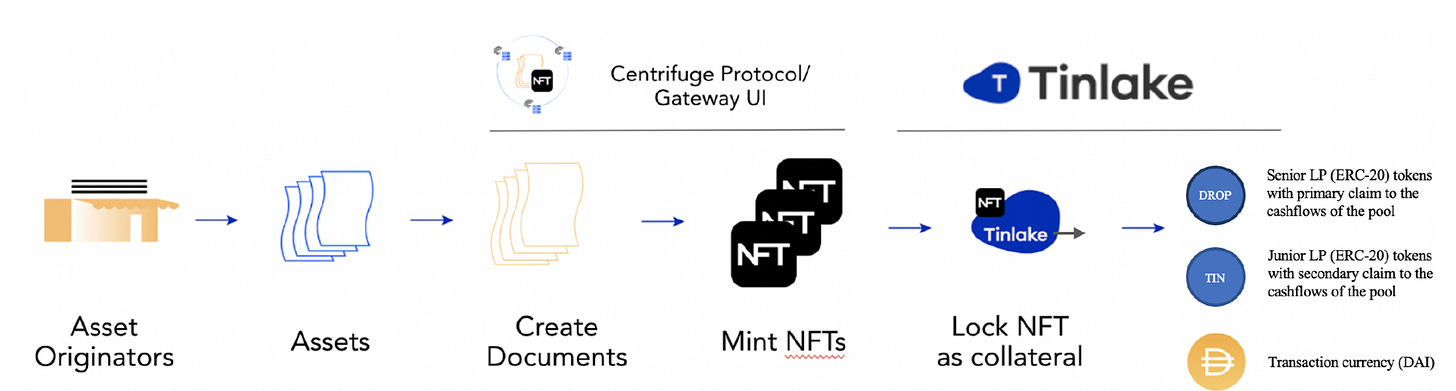

Figure 2: Asset tokenization via Centrifuge on Tinlake

Borrowers could tokenize their RWAs into NFTs, which were then grouped into asset pools. Investors could lock their stablecoins into these pools to earn yield and receive two types of ERC-20 tokens: (1) DROP tokens that represented the senior tranche with lower but more stable returns and (2) TIN tokens that represented the junior tranche with higher risk but greater potential returns. Borrowers could then draw stablecoins from these pools as loans.

Centrifuge effectively recreated asset-backed securities onchain. The company believed these tokenized asset pools could be integrated with other DeFi protocols to create significant synergies. For example, DROP tokens could be deposited into MakerDAO vaults, allowing MakerDAO to earn attractive risk-adjusted yields while Centrifuge could scale its platform by accessing MakerDAO’s theoretically unlimited balance sheet.

MakerDAO & Black Thursday

However, the idea of onboarding RWAs sparked intense debate within the MakerDAO community. At the heart of the controversy was a philosophical question: Should DAI, a decentralized stablecoin, accept assets that relied on traditional legal systems for custody and security?

While some viewed RWAs as an opportunity to grow MakerDAO and expand its reach beyond the crypto ecosystem, a core faction argued that introducing external dependencies could compromise the protocol’s decentralization and long-term resilience. The heated debates continued, but a series of events in early 2020 forced the community to confront its vulnerabilities head-on.

There are decades where nothing happens, and there are weeks where decades happen. For MakerDAO, Black Thursday (March 12, 2020) was one of those moments.

When the COVID-19 pandemic pushed global financial markets to the brink, crypto wasn’t spared. On Black Thursday, ETH’s price plummeted nearly 50% and triggered massive liquidation cascades across DeFi. The crash also left many MakerDAO vaults undercollateralized and the protocol started liquidating collaterals to stabilize the system.

However, extreme congestion on the Ethereum network delayed the liquidation process and the auctions started clearing with little to no competitive bids. This allowed some participants to win with near-zero DAI bids and left the vault holders uncompensated for their liquidated collateral. Cumulative losses were significant, amounting to $8.3 million.

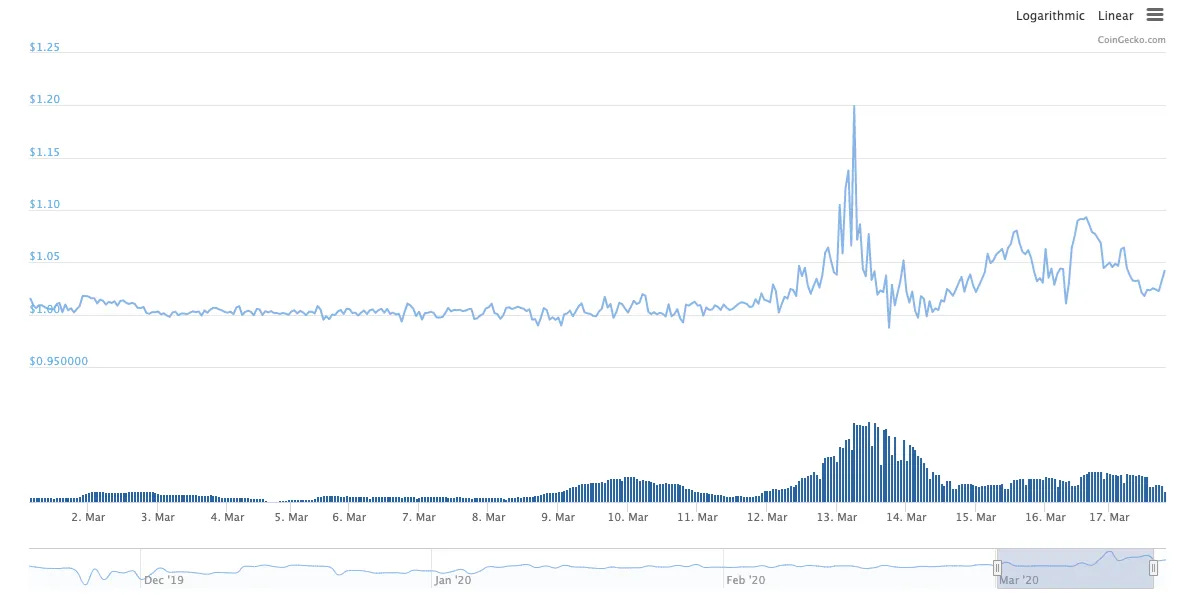

Figure 3: Price of DAI against USD on Black Thursday

This auction failure created a shortage in DAI supply and pushed its price above the $1 peg. To address the crisis, MakerDAO held an emergency meeting and minted new MKR tokens to raise funds, diluting MKR holders to fill the collateral gap.

The intervention restored DAI’s peg and stabilized the protocol, but Black Thursday exposed the fundamental vulnerability of relying exclusively on crypto collateral. The crisis served as a wake-up call for MakerDAO members. Many shifted their views on RWAs and began embracing them as a crucial tool for stabilizing the DAI ecosystem and preventing future crises.

III. MakerDAO Embraces RWAs

Driven by the need for diversification, MakerDAO began exploring RWAs for its long-term strategy. Yet, bringing these traditional assets into its vaults posed significant technical, legal, and operational challenges.

(1) Legal Framework

Unlike crypto assets, RWAs exist offchain and require enforceable written credit agreements in order to be used as collateral. However, since DAOs are not legal entities, executing such documents would be a challenge. This required developing novel legal frameworks to bridge the gap between decentralized governance and traditional contractual obligations.

(2) Liquidation

Unlike onchain assets, RWAs cannot be automatically liquidated through smart contracts. Managing offchain collateral requires human oversight to monitor compliance and initiate the liquidation process. Moreover, selling RWA collateral introduces extra challenges, from determining fair value to finding buyers in often illiquid secondary markets.

(3) Underwriting Credit Risks

Establishing vaults for RWA collateral was far more complex than for onchain assets, requiring extensive commercial risk and legal diligence. Coordinating reviews, dealing with extreme adverse selection, and gathering consensus from MakerDAO’s decentralized community further intensified this complexity.

Centrifuge Vaults

Despite these hurdles, MakerDAO forged on, experimenting with innovative models to overcome these operational complexities.

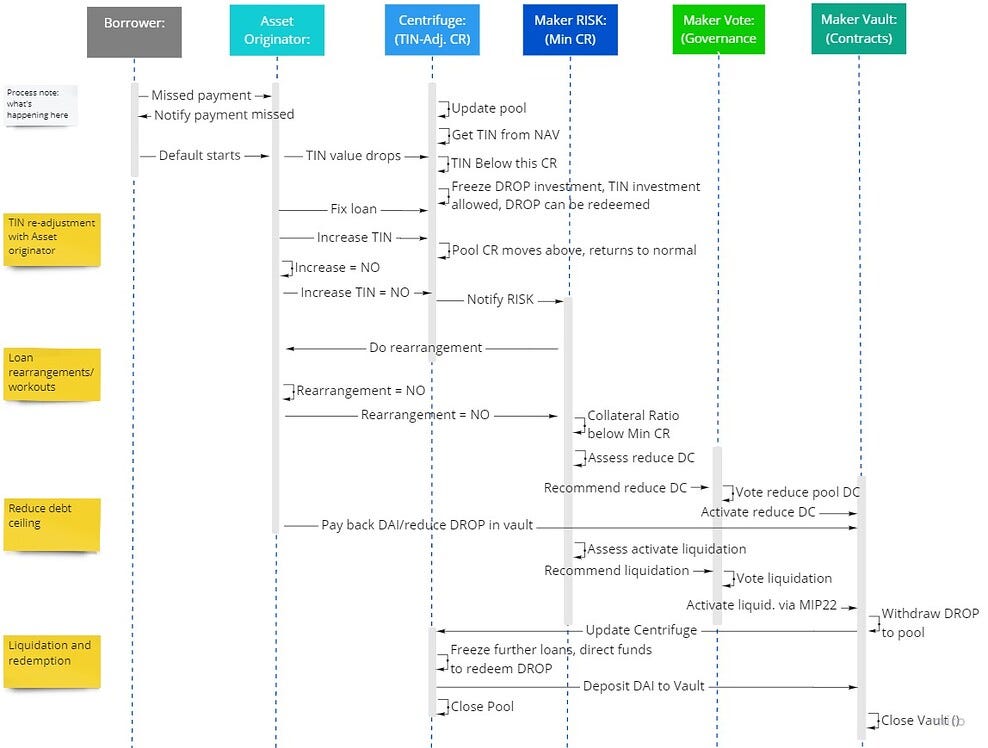

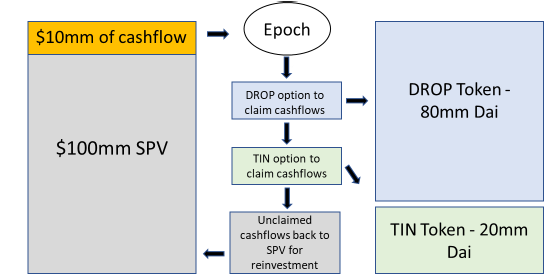

Figure 4: An illustrative example of Centrifuge’s TIN-DROP structure

In 2021, MakerDAO launched its first set of RWA vaults by partnering with Centrifuge. Using the Tinlake structure, the safer DROP tokens were integrated into MakerDAO vaults and enabled DAI borrowing against the RWA collateral. The Centrifuge model addressed the key RWA challenges in the following ways.

On the legal front, RWAs were securitized and held by special purpose vehicles (SPVs) to ensure compliance with traditional legal frameworks. Investors signed subscription agreements that prevented the SPV from pledging assets elsewhere and ensured cash flows followed the smart contract’s seniority rules. While MakerDAO couldn’t directly sign these agreements, it benefited from an implied claim on the assets, as all other investors were bound by the agreements. Any amendments required unanimous investor consent, making unauthorized changes virtually impossible.

Figure 5: Risk mitigation process for Centrifuge Vaults

Risk mitigation was implemented through multiple layers of protection. Centrifuge actively monitored the net asset value (NAV) of TIN tokens, and if the collateralization ratio fell below predefined threshold, Tinlake would freeze new DROP investments and halt lending until the ratio recovered. MakerDAO also retained liquidation rights that allowed the SPV to repossess underlying collateral on behalf of DROP token holders when necessary. Lastly, TIN investors, which included the borrower, created an additional buffer for MakerDAO’s capital by absorbing initial losses.

6S Capital’s Standalone Vault

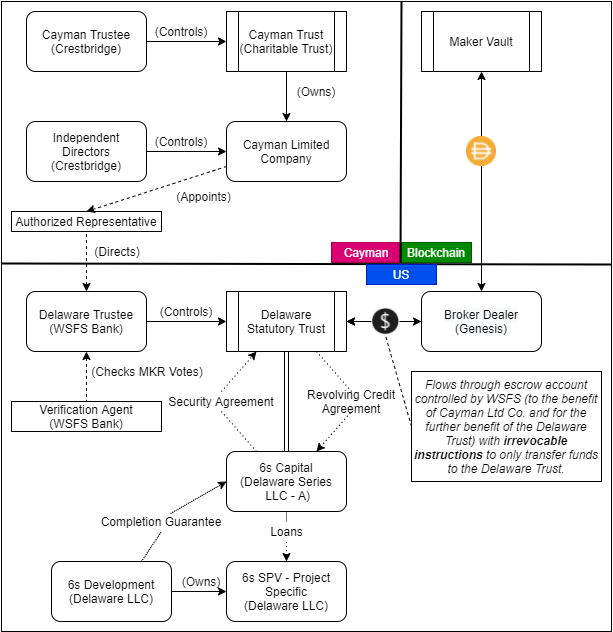

Parallel to its Centrifuge partnership, MakerDAO collaborated with 6S Capital (6S) to provide construction and acquisition loans to real estate developers. Under this model, MakerDAO financed 70% of each loan, while 6S contributed the remaining 30% as equity.

Figure 6: Visual overview of the 6S Capital trust structure

6S introduced a different legal structure, employing a Delaware Statutory Trust with MakerDAO as the beneficiary. A Maker Representative was appointed to execute legal documents and serve as the protocol’s legal interface, while a trustee handled administrative responsibilities based on onchain governance votes.

Risk management measures included quarterly compliance reviews by the Maker Representative and liquidation process that could be initiated by MakerDAO. Similar to the Centrifuge model, 6S’s 30% equity stake protected MakerDAO’s position by providing a first-loss buffer.

Huntingdon Valley Bank Partnership

In 2022, as the crypto market entered another bear phase and demand for crypto-backed loans declined, MakerDAO doubled down on RWA integration to counter declining stability fee (crypto lending) revenues.

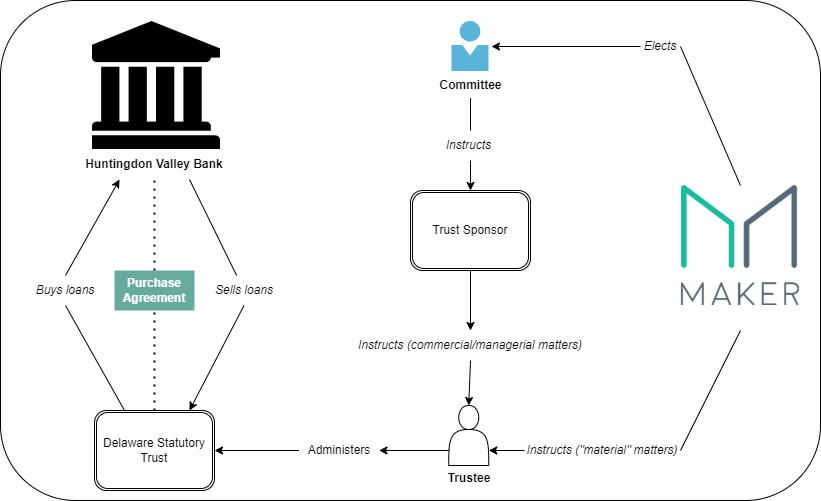

A monumental development came from Huntingdon Valley Bank (HVB) which proposed selling a portion of its real estate and business loans in exchange for a 100 million DAI credit line. When the vault was approved in August 2022, it became MakerDAO’s first large-scale RWA vault. For context, all other RWA vaults collectively only amounted to 32 million DAI at the time.

Figure 7: Simplified structure of the HVB & MakerDAO partnership

HVB utilized a Delaware Statutory Trust as the intermediary, mirroring the successful structure from the 6S partnership. This approach ensured legal compliance while maintaining alignment with MakerDAO’s decentralized governance framework. Risk alignment was achieved through HVB retaining at least 50% pari-passu exposure for each loan, ensuring the bank had significant “skin in the game.”

BlockTower RWA Vaults

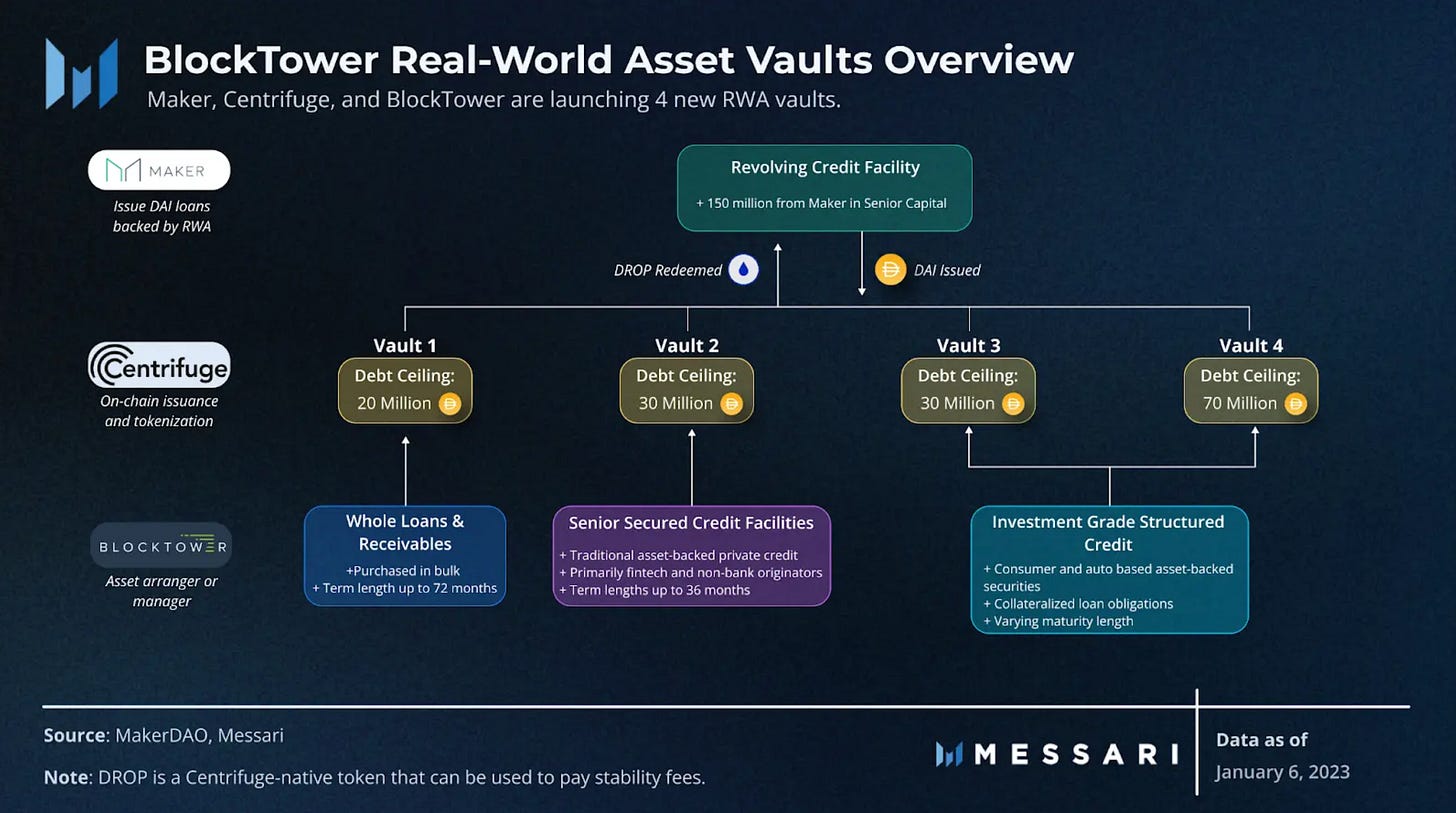

In December 2022, a three-way partnership emerged between BlockTower Credit (BlockTower), MakerDAO, and Centrifuge, creating a 220 million DAI RWA vault in MakerDAO’s ecosystem. Each party played a distinct role: Centrifuge handled tokenization, BlockTower managed the assets, and MakerDAO provided DAI loans against the RWA collateral.

Figure 8: Overview of the BlockTower RWA Vaults

While the initial plan was to establish four different vaults, rising interest rates led to a pivot towards two vaults focused on investment-grade structured credit, emphasizing shorter-duration collateral for easier liquidation in the face of macroeconomic headwinds. The partnership established the Trust-Administered Optimization Foundation (TACO) to facilitate real-world activities, with BlockTower managing assets under MakerDAO’s onchain governance guidance.

BlockTower strengthened risk alignment by contributing 30% junior capital through TIN tokens to absorb initial losses. The company also retained MKR tokens to demonstrate its commitment to the protocol’s long-term success.

MakerDAO’s Lasting Lessons

MakerDAO’s adoption of RWA vaults marked a pivotal moment for DeFi. By establishing new frameworks that bridged TradFi and DeFi, MakerDAO set the blueprint for integrating RWAs into the DeFi ecosystem. These vaults validated early adopters’ claims that incorporating RWAs could reduce systemic risk by decreasing reliance on volatile crypto assets while enhancing revenue through additional yields.

However, operational challenges in integrating offchain assets slowed the pace of new RWA deals and limited their broad adoption. Borrowers often struggled with navigating MakerDAO’s decentralized structure, finding additional time and effort difficult to justify unless financing costs were significantly lower than those in traditional markets. While MakerDAO laid the foundation for RWA integration, these challenges highlighted the need for more innovative solutions.

IV. Underwriting the Real World

DeFi lending platforms have relied on overcollateralization, where borrowers deposit more collateral than the value of their loan. This model, however, limited RWA adoption as tokenizing offchain assets presented new complexities. To circumvent this issue, protocols could require real-world borrowers to first acquire crypto assets, but this would defeat the purpose of the loan.

Uncollateralized lending emerged as a viable alternative to overcome this limitation. This approach allowed borrowers to access funds without providing crypto or tokenized RWA collateral, while lenders could earn higher returns as compensation for providing unsecured loans.

In the absence of collaterals, however, platforms had to develop innovative checks and balances to deter fraudulent borrower behavior and safeguard stakeholders in the event of defaults.

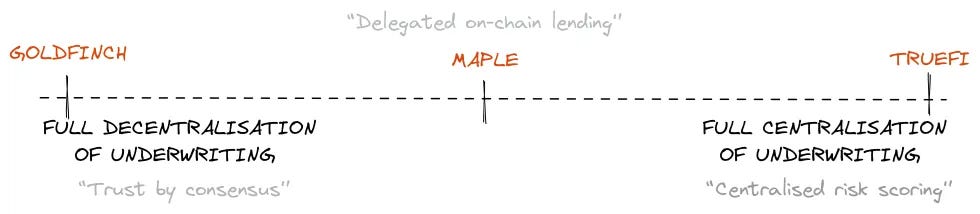

Figure 9: Spectrum of uncollateralized DeFi lending models

TrueFi: Centralized Risk Scoring

Launched in November 2020, TrueFi pioneered a centralized risk-scoring model where governance participants held direct responsibility for loan assessment and backstopping.

TrueFi’s governance was managed by TRU token holders who staked their tokens to participate in protocol governance and earn profits. These stakeholders evaluated and voted on new loan applications, with their staked tokens serving as reserves that could be liquidated in the event of borrower defaults.

The platform maintained strict borrower through a comprehensive onboarding process that included community-driven reviews and legally binding credit agreements. Once approved, borrowers received personalized credit limits and loan terms based on their credit profile, with the legal agreements providing recourse if defaults occurred.

Lenders could deposit supported stablecoins into the platform’s general lending pool to earn both interest and TRU token rewards. The protocol used staked TRU tokens as the primary defense mechanism against defaults, as they could be liquidated to compensate lenders for any losses.

Goldfinch: Trust by Consensus

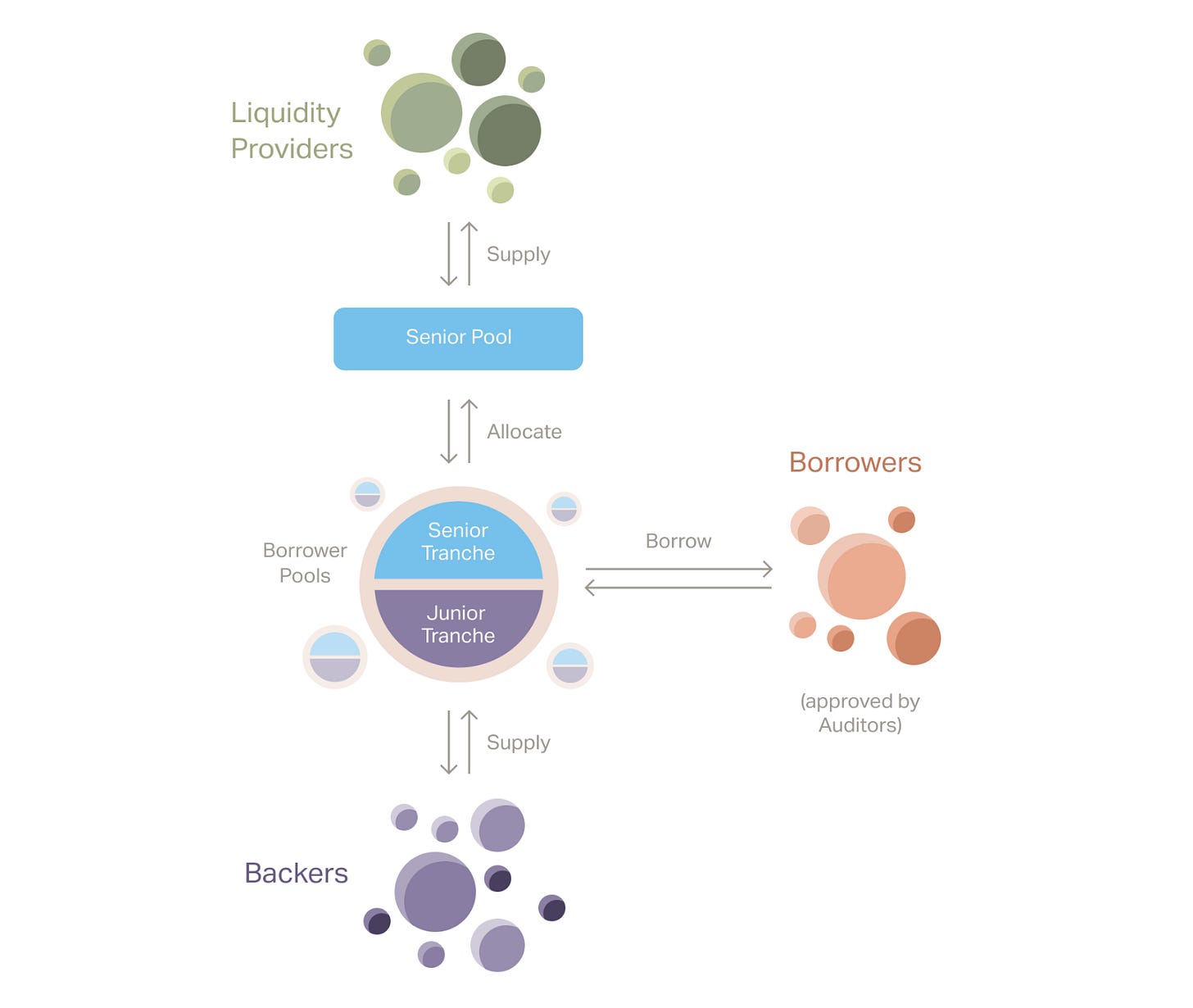

Launched in 2021, Goldfinch introduced a decentralized "trust by consensus" model with a unique tranche-based risk distribution approach.

Figure 10: Architecture diagram of the Goldfinch model

The protocol operated under a more decentralized model where GFI holders could stake their tokens to participate in governance decisions and earn a share of profits. These stakeholders were responsible for overseeing the protocol’s governance and operational framework.

Borrowers initiated the lending process by submitting detailed loan proposals that underwent a two-step review process. Auditors first conducted background checks, followed by Backers’ evaluation for loan approval. Once approved, borrower interest payments were distributed across different tranches and a reserve fund managed by GFI token holders.

The platform implemented a dual-layer lending structure similar to Centrifuge’s Tinlake model. Backers that approved the loan had to supply capital to the junior tranche, accepting higher risk for potentially higher returns. Liquidity Providers supplied capital to a general pool that funded the senior tranche of individual vaults, offering more stable but lower returns. Senior tranche participants could withdraw their funds at any time, subject to pool liquidity, while Backers needed to wait until senior tranche repayment.

Risk management was distributed across multiple stakeholders and mechanisms. Auditors staked GFI to perform borrower background checks and could earn additional GFI based on their performance. Borrowers were required to stake GFI tokens, which could be penalized through slashing in cases of misconduct or rejected loan applications. And the tiered tranche model provided additional protection, with both the reserve fund and junior tranche investors serving as buffer to absorb initial losses and shield senior participants.

Maple Finance: The Hybrid Approach

Maple Finance, launched in 2021, introduced a delegated lending model that combined DeFi with institutional-grade loan management. The protocol was governed by MPL (now converted to SYRUP) token holders who voted on both Pool Delegate applications and protocol upgrades.

Pool Delegates served as professional underwriters within the system, performing comprehensive credit assessments, negotiating terms with borrowers, and executing credit agreements before submitting loan requests onchain. The protocol also utilized a tranche-based structure where Pool Delegates were required to stake capital in the junior tranche, creating a first-loss buffer to protect senior tranche lenders.

Lenders could allocate capital across different pools based on their risk tolerance and desired returns, with legally binding agreements providing recourse against defaulting borrowers. The Pool Delegates’ junior tranche position acted as the primary defense against defaults, ensuring their interests remained strongly aligned with the protocol’s success through direct financial exposure.

Limitations

While these uncollateralized lending approaches showed promise, the lack of collateral ultimately introduced significant operational challenges.

The limitations became evident with incidents like the Tugende Kenya default on Goldfinch. After breaching loan covenants by making an unauthorized $1.9 million related-party loan, Tugende Kenya eventually defaulted on its $5 million loan amid deteriorating macroeconomic conditions. The case highlighted the inherent risks of uncollateralized lending, particularly the difficulty in enforcing loan terms and preventing unauthorized actions by borrowers in the real world without collateral.

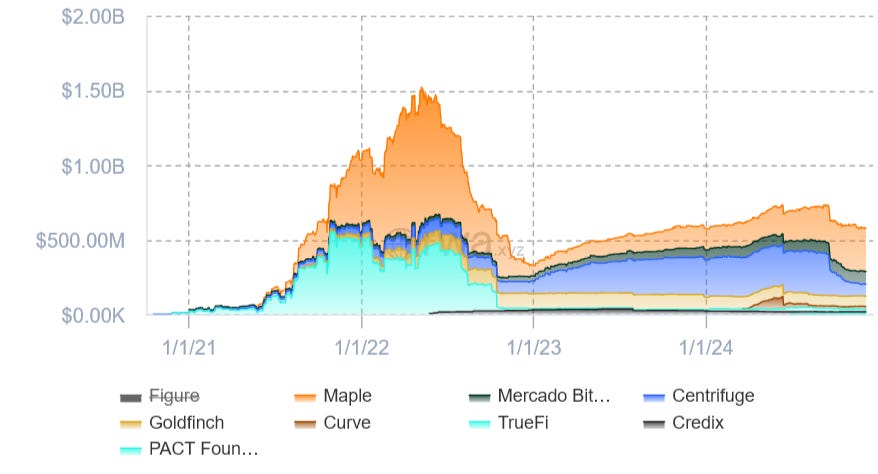

Figure 11: The rise and fall of uncollateralized lending in 2022

As the RWA market matured, it became clear that collateralization was essential for a widespread adoption, but perhaps a new type of a product was required. And unexpectedly, it would be the Federal Reserve (Fed) that provided the catalyst for this evolution.

V. The Edge Becomes the Center

Throughout most of crypto’s history, DeFi lending protocols consistently delivered higher yields than the risk-free rates offered by U.S. Treasuries.

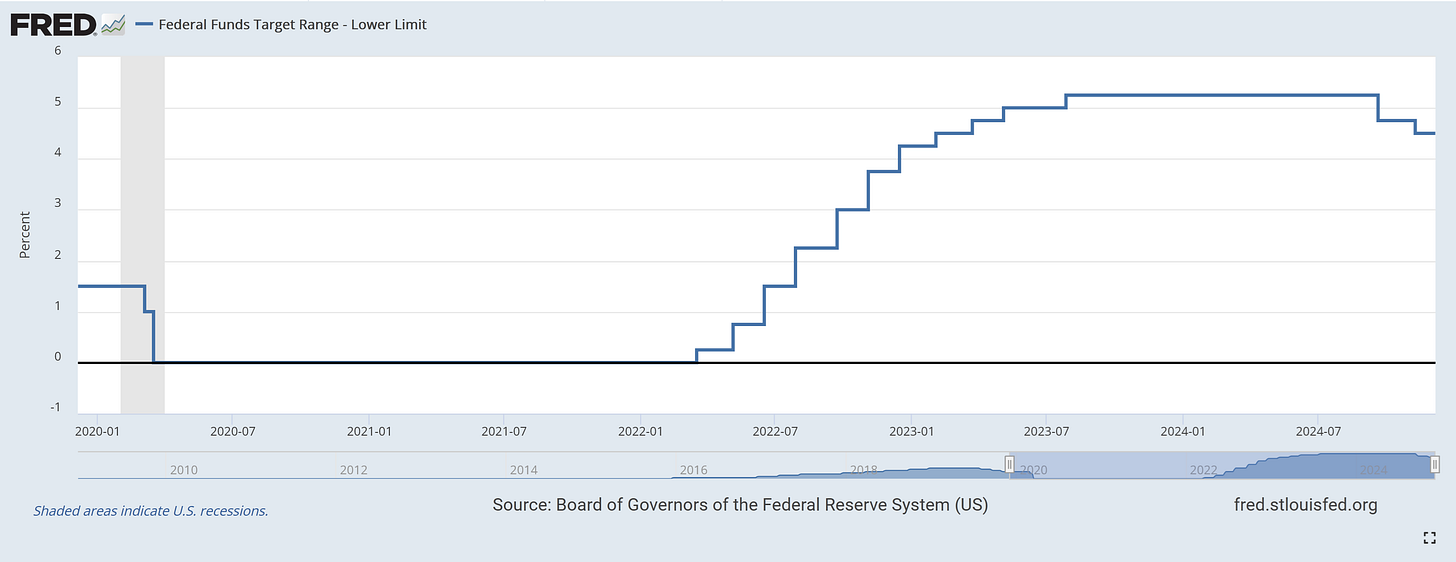

Figure 12: Federal Funds Target range (Lower Limit)

However, the Fed’s response to COVID-19 dramatically reshaped the yield landscape. After initially lowering benchmark rates and injecting substantial liquidity during the pandemic, rising inflation forced the Fed to reverse course and aggressively raise the Federal Funds Rate from 0.25% to 5.5% by July 2023. This created an unprecedented inversion where U.S. Treasuries began offering superior returns compared to leading DeFi lending protocols that were only generating around 3% yield on stablecoin deposits.

This fundamental shift transformed the market, as crypto investors started gravitating toward Treasury assets in pursuit of better risk-adjusted returns.

MakerDAO’s Treasury Strategy

The 2022 crypto bear market severely impacted MakerDAO as demand for DAI loans declined sharply. By July 2022, MakerDAO’s stablecoin collateral reached an unprecedented 85% of its total assets, effectively transforming DAI into a “wrapped USDC.” This shift undermined MakerDAO’s reputation and raised serious questions about DAI’s credibility as a decentralized stablecoin.

Figure 13: Evolution of DAI’s stablecoin backing (2020-2023)

The situation was exacerbated by centralized stablecoin issuers like Circle retaining the yields from underlying deposits rather than passing them to USDC holders, leaving MakerDAO's substantial stablecoin reserves idle. As interest rates continued to rise, MKR token holders increasingly demanded access to these underlying yields.

In response, MakerDAO developed a new strategy: directly investing in short-term U.S. Treasuries. And the protocol selected two arrangers to implement this vision: Monetalis (Clydesdale) and BlockTower (Andromeda).

Monetalis, a firm specializing in bridging TradFi and DeFi, launched its vault in October 2022 to invest excess Peg Stability Model (PSM) stablecoin reserves into U.S. Treasury assets. While the vault initially focused on Treasury ETFs, it later pivoted to direct short-term Treasury bill investments to maximize efficiency and yield. The strategy was successful and the vault’s debt ceiling was progressively increased from 250 million DAI to 500 million DAI, and ultimately to 1.1 billion DAI.

BlockTower approached MakerDAO with insights from their previous RWA vaults. The team identified short-term U.S. Treasuries as an optimal investment opportunity, noting government debt offered attractive risk-adjusted returns in the high-rate environment while presenting fewer underwriting challenges than other credit assets. BlockTower’s Andromeda vault was launched in June 2023 with a 1.3 billion DAI debt ceiling. The vault utilized the same TACO structure, where BlockTower managed assets according to foundation instructions guided by MakerDAO governance.

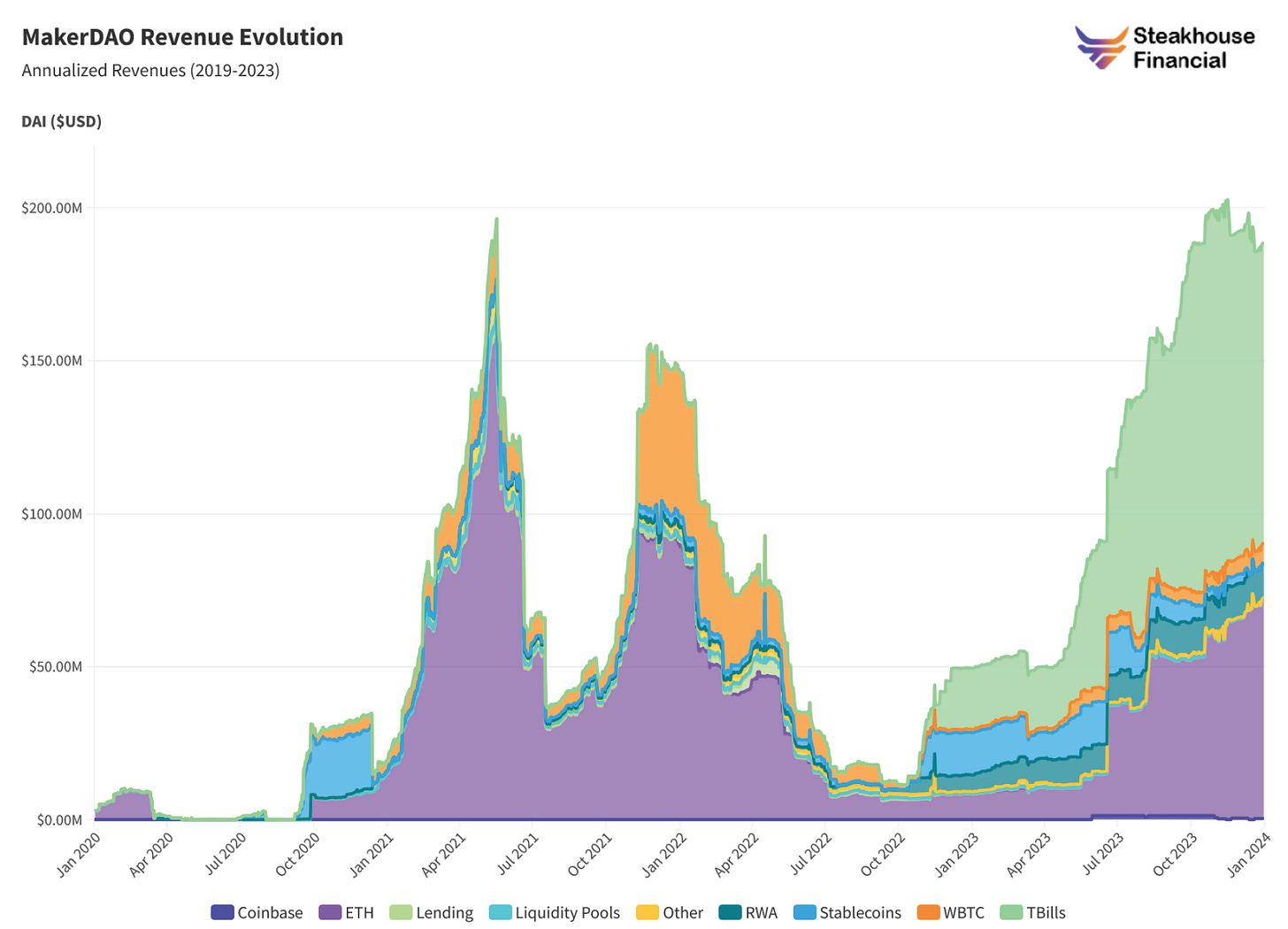

Figure 14: Evolution of MakerDAO’s Revenue

The arranger vault initiatives successfully achieved MakerDAO’s objectives, strengthening its balance sheet by increasing RWAs backing from 12% in 2022 to 47% in 2023 and significantly boosting its revenue with Treasury assets.

Tokenized Money Market Funds

The crypto industry’s embrace of U.S. Treasuries probably wasn't on anyone's bingo card, but tokenized money market funds (MMFs) quickly became the next gold rush.

Their appeal was simple. Many onchain entities, from DAO treasuries to crypto investment firms, held substantial liquid reserves in stablecoins like USDT and USDC. While these stablecoins provided necessary liquidity, they generated no native yield. Previously, these assets could be deployed to DeFi lending protocols for returns, but this strategy lost its appeal as TradFi rates began outperforming DeFi yields.

This yield differential drove onchain participants towards real-world risk-free returns. However, moving stablecoins between blockchain and TradFi systems involved significant friction, including high fees and multi-day settlement delays. Tokenized MMFs solved this problem by providing direct, onchain access to treasury yields.

Figure 15: Flow diagram of OUSG

Ondo Finance (Ondo) emerged as an early leader in this space by launching OUSG, a tokenized MMF backed by BlackRock's U.S. Treasuries ETF. To expand its ecosystem, Ondo introduced Flux Finance, an Aave fork that allowed OUSG holders to use their tokens as collateral for borrowing. OUSG gained rapid adoption, but their reliance on BlackRock’s existing ETF structure added extra fees and did not introduce fundamental innovation as it was essentially a wrapped TradFi product.

TradFi Enters the Arena

Recognizing the potential of tokenized MMFs, traditional asset managers began making strategic moves into the blockchain space.

Franklin Templeton planted the initial seed in April 2021 by launching Franklin Onchain U.S. Government Money Fund (FOBXX). While the fund operated offchain, share ownership and transactions were recorded on the blockchain. Each share was tokenized as a BENJI token, which investors could manage through the Benji Investment App. Although not classified as a stablecoin, BENJI maintained a stable $1 share price and offered current income while preserving capital and liquidity.

The firm’s initial blockchain adoption aimed to optimize operations and reduce costs. However, growing demand for tokenized MMFs from crypto investors revealed a bigger opportunity: using blockchain technology as a distribution channel for reaching crypto-native users.

To make the product more appealing to these users, Franklin Templeton implemented key upgrades to improve BENJI’s integration within the crypto ecosystem. Peer-to-peer BENJI token transfers in secondary markets were enabled in April 2024 and USDC purchases were permitted in August 2024.

Following Franklin Templeton’s success, BlackRock entered the space in 2024 by launching its BlackRock USD Institutional Digital Liquidity Fund (BUIDL) in partnership with Securitize. Like FOBXX, BUIDL invested entirely in cash and cash equivalents, including U.S. Treasury bills and repurchase agreements, while maintaining a stable $1 token value and supporting peer-to-peer transfers.

For many years, the crypto community has prophesized that institutions were coming onchain. While the notion was often dismissed by outside observers, the launch of BENJI and BUIDL demonstrated that major institutions were not only entering the space but actively building new onchain financial products.

Treasury-backed Stablecoins

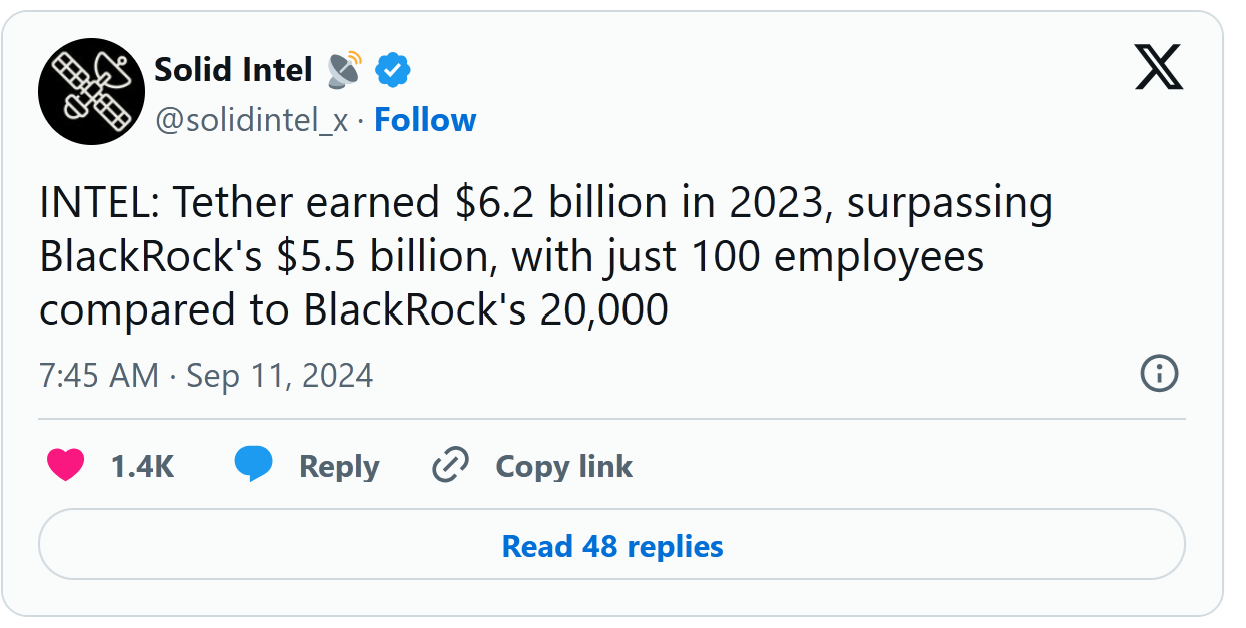

Figure 16: Tether’s record profit continues

As centralized stablecoin issuers like Tether and Circle continued to generate record profits in the high interest rate environment, questions emerged about the disconnect between those creating value (users, DeFi applications, and market makers) and those capturing it (the issuers themselves).

As Jeff Bezos famously said, “Your margin is my opportunity.” These lucrative profit margins inevitably drew new competitors in the stablecoin market.

Inspired by the success of tokenized MMFs, Mountain Protocol launched USDM, a stablecoin directly backed by short-term U.S. Treasuries that automatically distributed underlying yields to holders. Following a similar model, M^0 Protocol introduced a decentralized platform enabling approved minters to issues M, its stablecoin, by collateralizing U.S. Treasury assets.

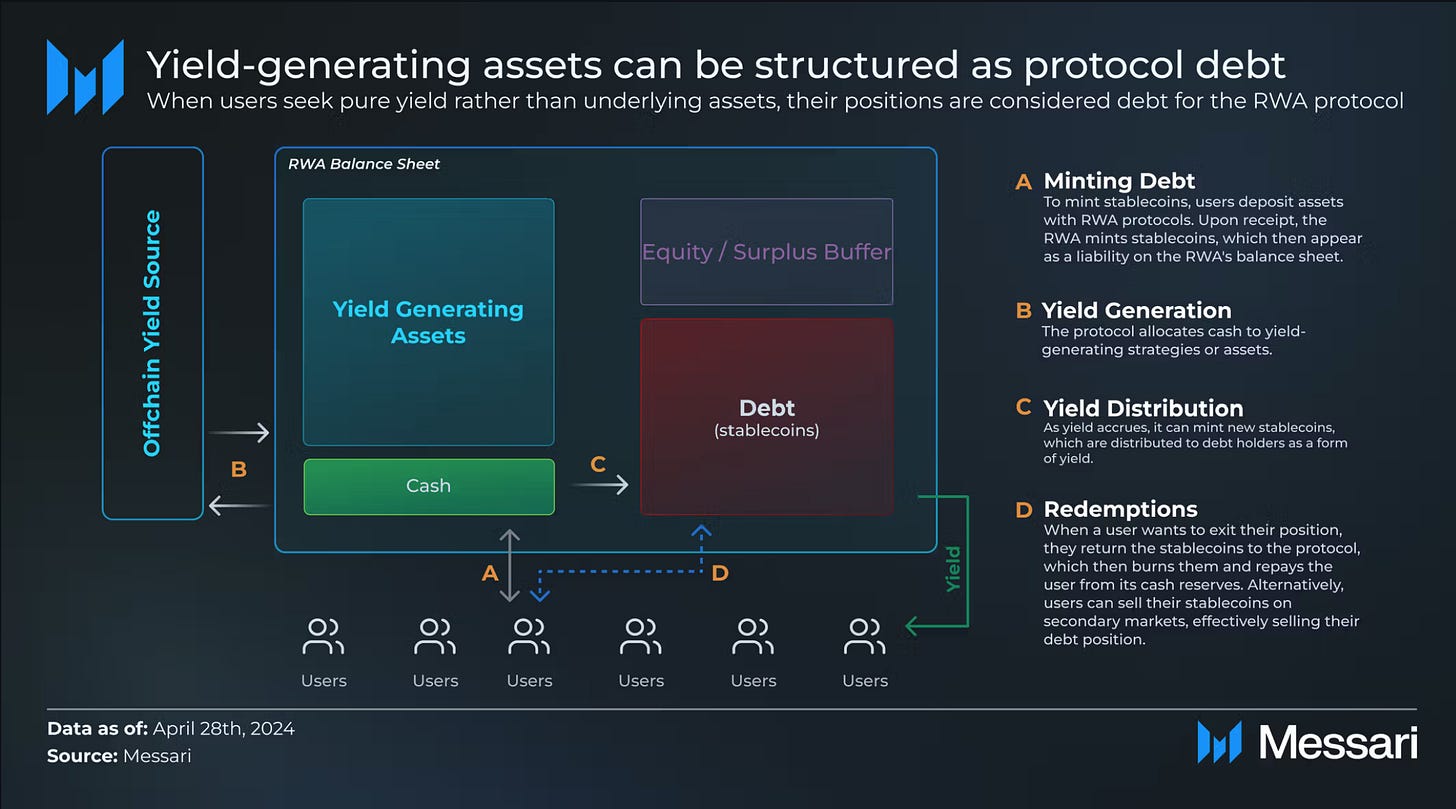

While stablecoins like USDM and M, and tokenized MMFs like OUSG share similar Treasury collateral and $1 price targets, they are fundamentally structured differently.

Figure 17: Stablecoins are debt issued based on yield generating collateral

OUSG represents tokenized equity interests in a Treasury-holding fund, while USDM and M function as liabilities backed by Treasury collateral, similar to MakerDAO’s DAI model. Although both models require KYC for primary issuance and redemption, tokenized equity products like OUSG face more stringent regulatory requirements, including restrictions on secondary transactions, which limit their utility in DeFi. In contrast, USDM and M enable unrestricted transferability in secondary markets and broader DeFi compatibility, making them more attractive for onchain users.

Looming Challenges

While tokenized treasuries have achieved significant growth and established a strong preference in DeFi, their appeal will likely diminish as traditional market interest rates decline and DeFi yields increase amid renewed crypto market optimism. To maintain their relevance and continue growing, RWA protocols need to evolve and develop strategies that address this imminent market shift.

VI. Following the Yellow Brick Road

RWA protocols appear to be addressing the looming yield challenge through two broad approaches: (1) tokenizing higher-yielding TradFi assets and (2) developing structured yield products.

Tokenizing Higher-Yielding TradFi Assets

RWA protocols have experimented going beyond U.S. Treasuries by tokenizing private credit and private equity products.

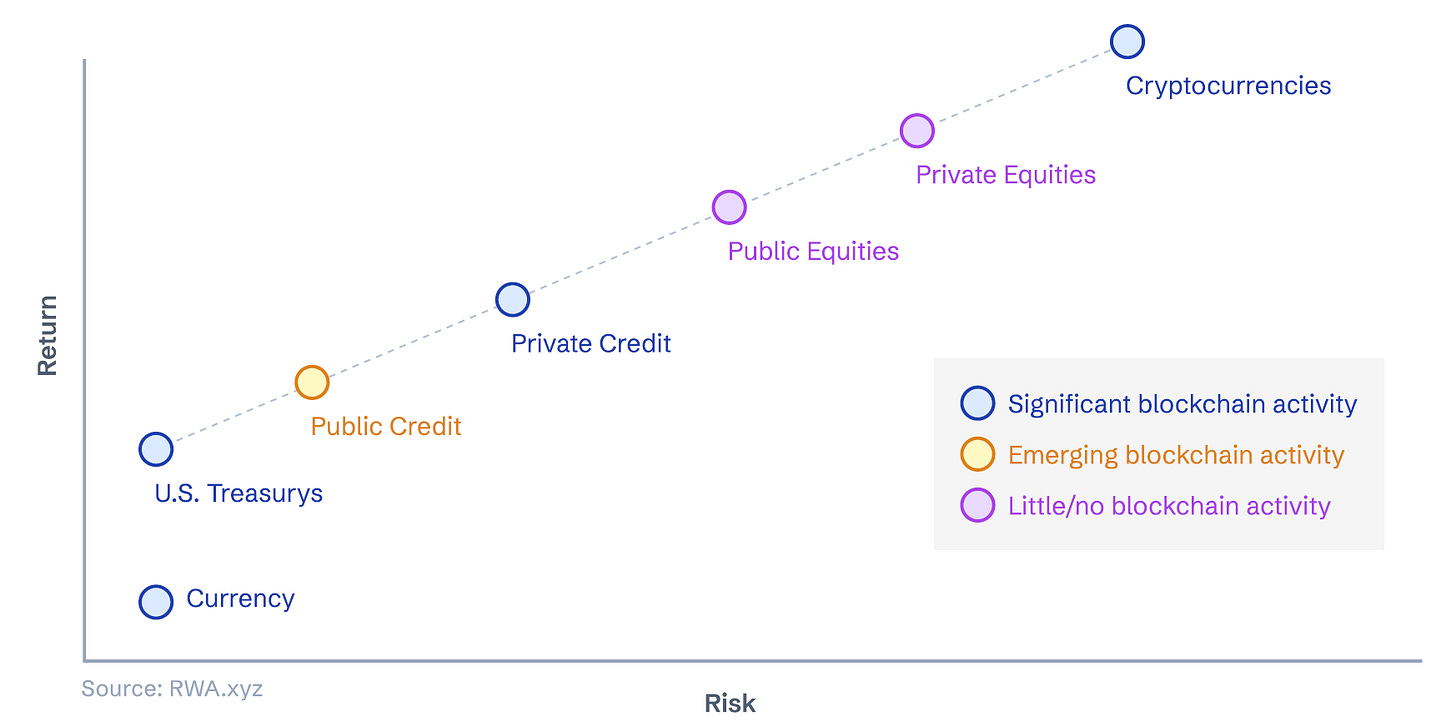

Figure 18: The investment risk curve and tokenization

Securitize and KKR pioneered this expansion in September 2022 by tokenizing a portion of KKR’s Healthcare Strategic Growth Fund II on the Avalanche blockchain. Their tokenized feeder fund structure significantly lowered minimum investment thresholds, making KKR’s growth equity fund more accessible to a broader investor base. Following this model, Hamilton Lane launched a tokenized version of their Equity Opportunities Fund V through Securitize's feeder fund structure in January 2023.

However, these private market initiatives encountered significant obstacles for mass adoption. They presented onchain integration challenges and the strict KYC requirements excluded many retail crypto investors. Additionally, there was limited market demand since crypto users preferred the risk-adjusted returns from tokenized Treasuries and products with greater DeFi compatibility.

Developing Structured Yield Products

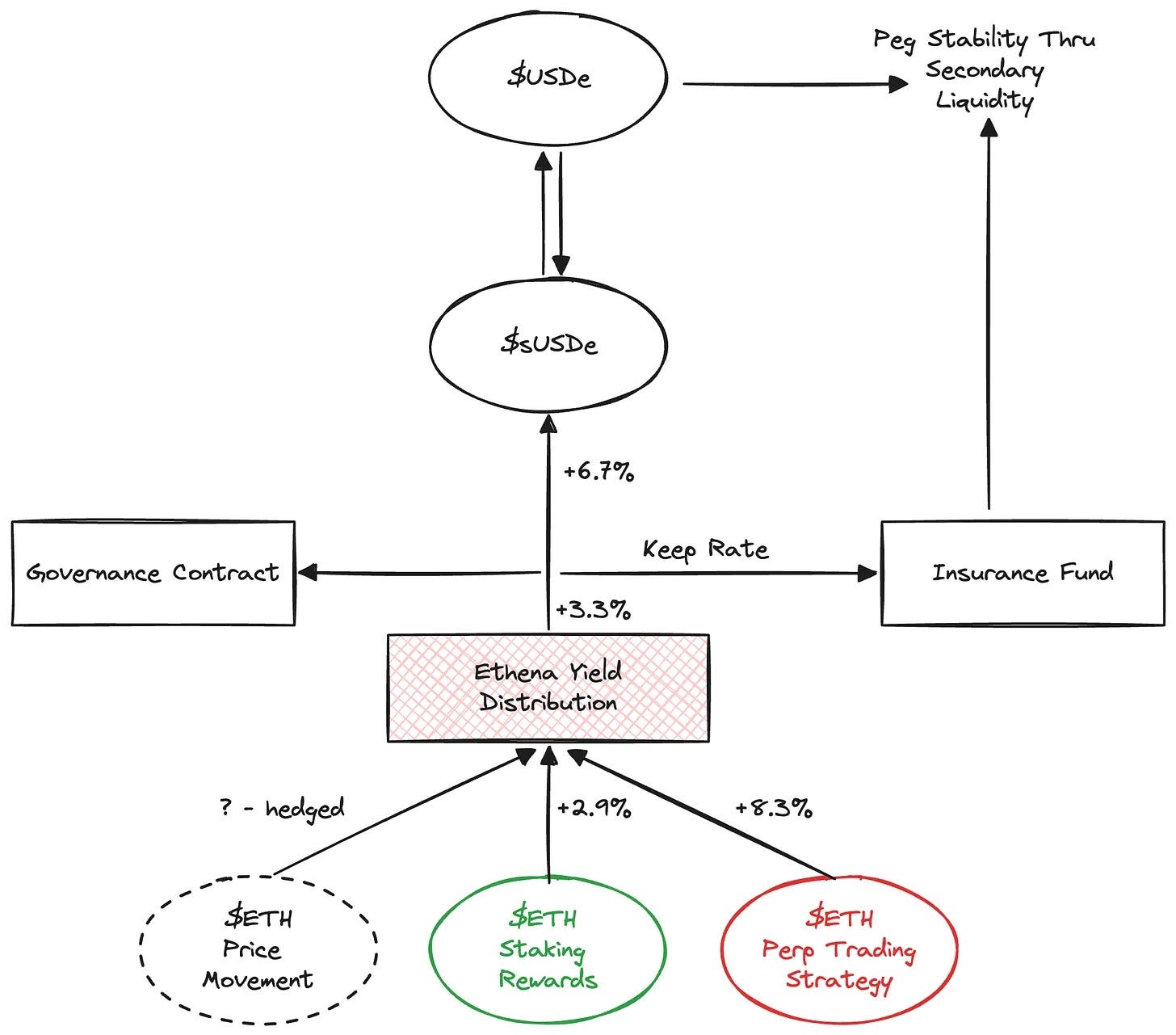

Ethena took a different approach by utilizing delta-neutral carry trades to generate enhanced yields.

In a delta-neutral trade, price exposure is eliminated by hedging. For instance, volatile stETH (staked ETH) positions could be hedged with matching short positions in ETH perpetual futures, enabling investors to earn staking rewards while neutralizing price risk. Any gains or losses in stETH are balanced by corresponding losses or gains in the short futures position, preserving the staking yield.

The carry trade aspect introduces an additional yield source. Crypto perpetual futures markets generally exhibit a long bias, with traders taking bullish positions outnumbering those taking short positions. This imbalance results in positive funding rates, where long traders must compensate short traders to maintain market balance. Ethena capitalized on this dynamic by capturing the funding rate income through its short positions.

Figure 19: Ethena’s yield distribution mechanism (rates as of July 2024)

By combining staking rewards with perpetual futures funding income, Ethena created USDe, a stablecoin that users could mint by depositing stETH as collateral. USDe holders could then stake their tokens within the ecosystem to earn the high yields generated by the protocol.

Despite concerns about scalability, particularly regarding ETH perpetual market capacity and Ethena’s potential market impact, USDe has achieved significant adoption. The protocol has rapidly emerged as a major player in the yield-bearing stablecoin market, demonstrating strong integration across various DeFi protocols.

VII. To Be Continued…

The evolution of RWAs in DeFi represents a fascinating convergence of TradFi and DeFi. From MakerDAO’s pioneering integration of RWA vaults to the recent surge in tokenized Treasury products, the sector has demonstrated remarkable adaptability and innovation. These developments have not only enhanced DeFi’s stability and yield generation capabilities but have also attracted TradFi institutions into the space.

As the market continues to mature, however, RWA protocols face new opportunities and challenges. With declining interest rates, the sector’s ability to create new products beyond Treasury-based products will likely determine its long-term success. In part 2 of the handbook, we will draw insights from the history of RWAs and discuss how the sector can navigate this new environment.

Thanks for the wonderful sharing!

Great work