There are many great primers on stablecoins, but most of them focus on the basics. It was challenging to find something that went beyond that also covered the major trends and narratives while highlighting the limits of existing stablecoin products. That’s what prompted me to write this piece.

When Satoshi Nakamoto first released the Bitcoin Whitepaper in 2008, he envisioned a peer-to-peer electronic cash that would allow online payments to be sent directly without going through a trusted third party.

16 years later, Bitcoin surpassed $1 trillion of market cap and is rapidly gaining traction as an alternative store-of-value (aka “digital gold”). But, its high volatility and limited throughput (the Lightening Network has its own scalability issues and L2s are a recent phenomenon), prevented Bitcoin from becoming a digital payment solution as Satoshi originally intended.

Bitcoin’s success “birthed” the crypto industry and paved the way for new blockchain networks. But they all faced similar issue as the price volatility prevented their tokens from becoming a true medium of exchange. If only there was a way to stabilize the price while retaining the positive features of blockchain networks...

Reeve Collins, Craig Sellars, and Brock Pierce had the same thought back in 2014. To solve the problem. they co-founded Realcoin and launched the first fiat-backed digital currency that was backed 1:1 by the US Dollar (”USD”). Enter stablecoins.

Realcoin was later rebranded to Tether and acquired by new owners based in Hong Kong, who also owned the Bitfinex exchange. At the time, crypto exchanges lacked access to traditional banking infrastructure and needed an alternative way to allow their users to transact in the USD without leaving the network.

USDT, Tether’s stablecoin, was able to bridge this gap, acting as a reliable “tether” between all crypto exchanges and supporting user deposits and withdrawals. USDT quickly gained popularity and was integrated with Bitfinex. The stablecoin is perhaps one of the most successful crypto products in the market, with over $100 billion in circulation today.

But what’s so great about a coin that is pegged to the USD? It seems like the most boring product in an industry that is maddeningly innovative and degenerate.

Stablecoins combine the price stability of the USD (at least in dollar terms) with the benefits of blockchain. As much as we all love Bitcoin and Ethereum, it’s not practical to use them in daily transactions.

Crypto fundamentalists may preach the importance of decentralization and censorship resistance, but ordinary daily users only care about one thing: a fast and cheap way to transact using a widely accepted currency like the USD. Stablecoins may be boring, but they satisfy this need. Hence their popularity.

Like all other crypto assets, stablecoins do not require a centralized third-party to facilitate a transaction. Any two counter parties that want to transact can do so in a permissionless manner according to the rules established by the blockchain protocol. This provides three advantages over the existing financial system.

Faster & Cheaper Settlement: Stablecoins decrease transaction costs and result in much quicker settlement finality. This is the holy grail of all fintech payment endeavors and explains why many payment solutions are interested in adopting stablecoins.

Programmable: Stablecoins can be included in smart contracts that self-execute based on predetermined conditions. When money becomes programmable, it opens up new uses cases such as on-chain credit issuance, digital asset trading, automatic payments, prediction markets, etc.

Regulatory Arbitrage: Because stablecoins do not rely on existing financial infrastructure, they currently operate in regulatory grey zone. Through stablecoins, people without access to the USD can now tap into the U.S. financial system. Some may argue it’s a bug rather than a feature, but this is one of the tangible benefits currently provided by stablecoins.

One can make the case that aside from Bitcoin’s alternative store-of-value, stablecoins represent the most dominant use case for crypto. The metrics back this up with daily stablecoin settlement on Ethereum and Tron ecosystems now representing over $30 billion.

01. Creating Stablecoins

Let’s quickly recap the basics. Stablecoins can generally be created in three different ways: (1) fiat-backed, (2) crypto-backed, and (3) algorithmic.

(1) Fiat-backed (aka “Digital Dollars”)

As the name suggests, fiat-backed stablecoins are backed 1:1 by actual fiat currency like the USD. I’ll refer to them as “digital dollars” in this piece as they are essentially a dollar that’s wrapped and digitalized (tokenized) on crypto rails.

Digital dollars are created as follows:

Issuing company receives fiat currency deposit from users.

These deposits are held in reserve bank accounts. Once confirmed, the issuer mints an equivalent amount of digital dollars on the chosen blockchain.

Users can redeem their digital dollars for the underlying fiat currency through the redemption process facilitated by the issuer.

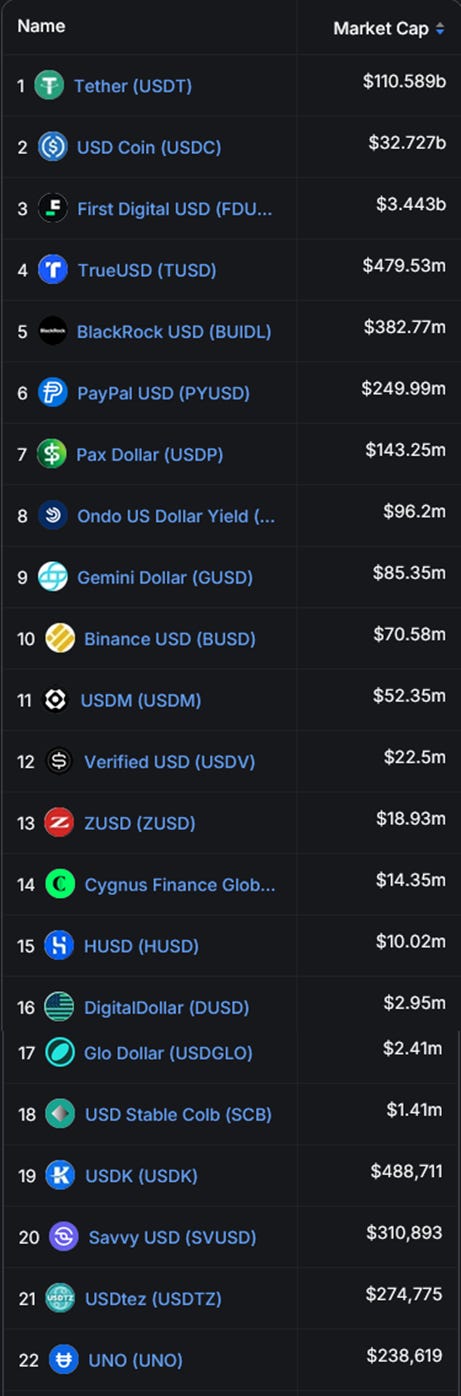

Figure 1: Stablecoin market share by market capitalization (July 2023).

Source: Defi Llama

Digital dollars are currently dominated by Tether’s USDT and Circle’s USDC, together which comprise over 80% of stablecoin market share.

Despite being the granddaddy of all stablecoins, USDT has faced much scrutiny over the years as Tether refused to disclose whether their digital dollars were truly backed 1:1 as the company claimed.

Many speculated that Tether didn’t hold 100% of its reserves in cash and cash equivalents like short-term U.S. Treasury, and instead invested a portion into riskier and more illiquid assets like longer dated U.S. Treasury, corporate papers, and other assets that generated better yields for the company.

Tether could have extinguished these concerns by publishing a report on its reserves, but their unwillingness to do so from 2014 to 2017 at least gives some credence to this rumor. The company finally started relying on quarterly attestations from 2022, but even that is still short of an audit demanded by many in the industry.

Whatever the truth is, seems like the crypto market has moved on from this issue for now. I suspect a lot of it had to do with the massive profits that Tether generated during the high interest rate environment. The alternative would have been catastrophic as the de-pegging of USDT would have been magnitudes worse than the blow-ups of Luna and FTX during the 2022 bear market.

The runner-up USDC was launched by Circle in 2018. To capture USDT’s market share, Circle pursued a slightly different strategic angle. It embraced a more regulatory compliant stance and focused on servicing the U.S. retail and institutions by forming a partnership with Coinbase.

If you would like to learn more about Circle and USDC, I highly recommend Packy McCormick’s long-form piece on his Substack.

(2) Crypto-backed (aka “Cryptodollars”)

Crypto-backed stablecoins are created via crypto-collateralized lending. To differentiate these from digital dollars, I’ll refer to them as “cryptodollars”. Cryptodollars are usually minted on DeFi protocols and their issuance mimics the credit creation associated with a new bank loan.

The most well-known example of cryptodollar is DAI, MakerDAO’s stablecoin. MakerDAO is a DeFi lending platform that was launched in 2017 on the Etherenum blockchain. The protocol mints DAI by allowing anyone to take out loans using other crypto as collateral. CoinDesk has a good article on how MakerDAO works.

DAI is created as follows:

A user sends an ERC-20 token to the MakerDAO smart contract (aka the vault).

These tokens become the collateral and allows the user to take out a loan denominated in DAI.

These loans are overcollateralized, meaning the user has to deposit more tokens than the loan borrowing to protect the lender against the volatility of the underlying collateral. Each ERC-20 token has a different collateral ratio depending on its risk profile.

For example, the minimum collateralization rate of ETH was 150% as of May 2024. In order for a user to borrow $10,000 worth of DAI, $15,000 worth of ETH needs to be collateralized.

A user can unlock the deposited ERC-20 token by paying back the DAI.

If the price of the ERC-20 token drops to a point that breaks the minimum collateral ratio, however, MakerDAO will automatically liquidate the collateral and payoff the loan.

Cryptodollars are similar to digital dollars, but there are some nuances. Unlike digital dollars that maintain the peg through its 1:1 reserve, DAI maintains its peg with the USD through arbitrage.

For example, if the demand for DAI decreases, its price will naturally fall below its peg of $1. This will encourage DAI borrowers to buy the cheaper DAI on exchanges to pay down the principal they have outstanding with MakerDAO.

The opposite happens if the demand for DAI is high, encouraging more people to lock in additional ETH into MakerDAO to borrow more expensive DAI. This increases the supply of DAI and will eventually bring the price down.

Unlike digital dollars issued by centralized entities, DAI is also permissionless. There are no custodial arrangements, meaning anyone with an Ethereum wallet and ERC-20 tokens can access the protocol to create DAI.

Despite these benefits, DAI’s market share falls well short of the big 2 (USDT and USDC). The biggest issue is DAI’s lower capital efficiency. Capital efficiency refers to the total amount of assets that a stablecoin needs in order to maintain its price stability.

Digital dollar’s capital efficiency is very high as you get 100% redemption for each USD that is deposited with the issuer. DAI, however, requires substantially more assets to maintain the peg. Efficiency is definitely an issue that cryptodollars need to solve before they can be more broadly adopted.

(3) Algorithmic

There have been many algorithmic stablecoin projects, but none of them is probably more famous than Luna’s UST.

Matt Levine wrote a great piece on how the UST was designed and worked before it failed. Tl;dr, all you need to know is that UST blew up spectacularly during the last bear market. And it’s safe to assume that there probably won’t be any demand for algorithmic stablecoins in the near future.

03. Stablecoin Trends & Narratives

What are the key trends and narratives that are shaping the stablecoin industry today? Let’s start with digital dollars.

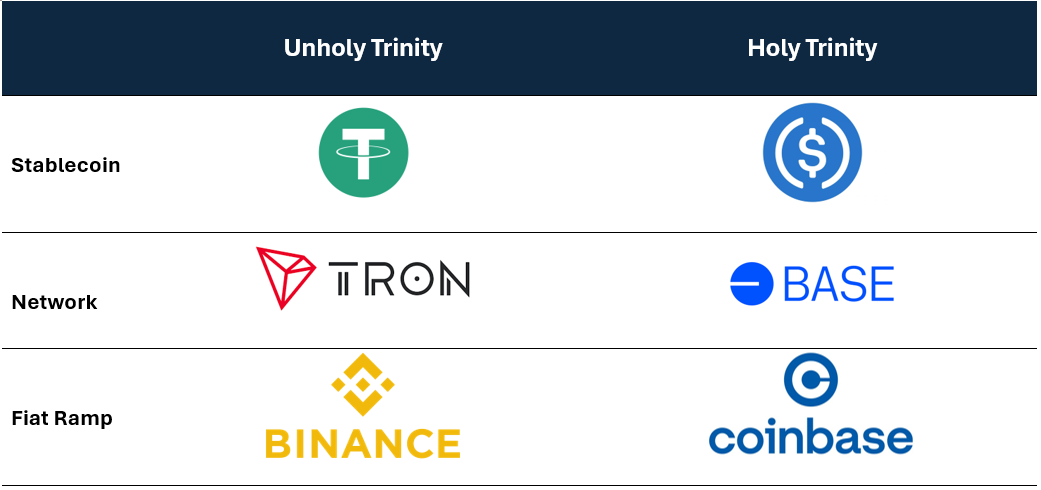

(1) “Unholy” vs. “Holy” Trinity

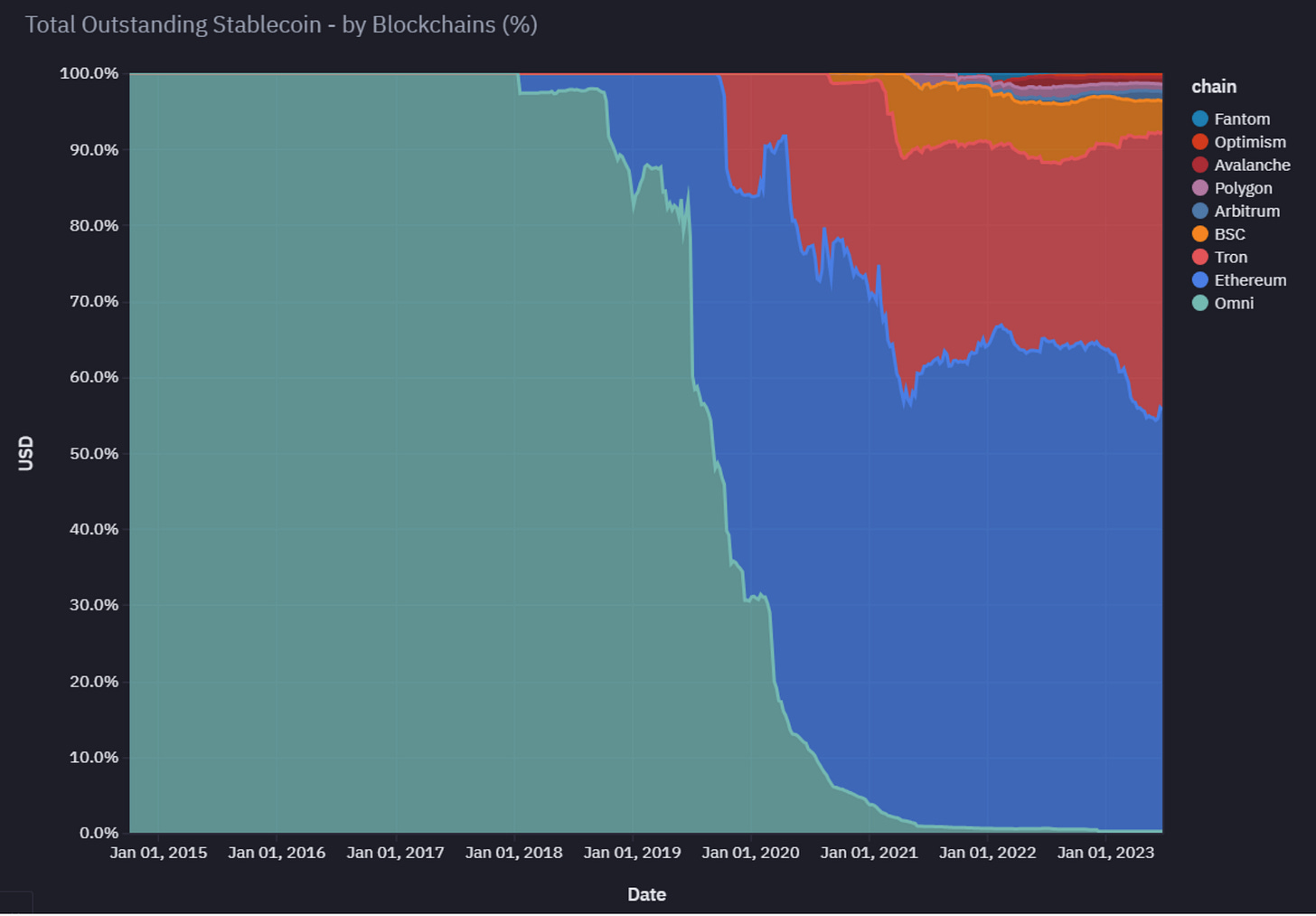

Figure 2: Total stablecoin (including USDC) supply split between Ethereum and Tron. Supply of USDT on the original Omni chain has mostly been retired.

Source: Liam Horne

One surprising fact about digital dollars is that Tether has more outstanding supply of USDT on Tron ($44 billion) vs. Ethereum Mainnet ($39 billion).

This uncomfortable truth has been bothering the Ethereum faithful for a while and Liam Horne, the former CEO of OP Labs, thoroughly investigated this topic on his website. His main takeaway is that USDT has been winning the stablecoin war through the “Unholy Trinity” of Tether, Tron, and Binance. He used the term “unholy” as each of the troika carries some baggage in the crypto world.

Tether: We already covered the potential reserve issues.

Tron: Founded by Justin Sun in 2017, the chain actually started as a fork of Ethereum but quickly became its antithesis. To create a network with cheap and low-latency settlement, Tron sacrificed decentralization to the point where many crypto fundamentalists now consider the network effectively centralized.

Binance: The exchange played a massively important role in Tron’s early success as it was one of the first to list Tron’s native token and used the network for depositing and withdrawing USDT. Binance is currently used by over 150 million customers in 180 countries, but had some regulatory strife with the U.S. government and completely exited the U.S. market.

Whatever their criticisms are, however, the “Unholy Trinity” met the retail users’ needs by enabling cheap and fast transactions as well as readily available fiat on & off-ramps. The transactions fees on Tron are no longer as affordable, but the network effect is keeping the retail users tethered to the chain.

To combat this narrative, USDC is forming its “Holy Trinity” with Ethereum and Coinbase. With the proliferation of L2s like Base and EIP-4844, transaction costs on Ethereum have finally went down to the point where retail payments now make sense. Coinbase is closely aligned as it owns a 15% stake in Circle and is also building Base L2.

Figure 3: Unholy Trinity vs. Holy Trinity.

Source: Me

With the strong counter offensive from the Holy Trinity, we are now entering the next phase of the digital dollar war between USDT and USDC. The digital dollar landscape and ecosystem will likely look very different in a few years.

(2) Increasing Competition

One of the key macroeconomic trends of 2020’s is rising interest rates. When the COVID-19 pandemic sent the entire financial market to the brink of collapse in March 2020, the Fed and the other central banks joined hands and aggressively cut their benchmark rates.

The unprecedented liquidity stabilized the markets and eventually led to one of the greatest price recovery witnessed in modern financial history. But when things began reverting back to normal, the excess liquidity, combined with pent-up demand and global supply chain issues, started building inflationary pressure. The Fed initially dismissed these concerns, but they could no longer claim it was “transitory” when the data proved them wrong.

Figure 4: Federal Reserve’s target rate & 10-year Treasury yield.

Source: The New York Times

Without any cover to keep the rates low, the Fed had to hike the Federal Fund Rate from 0.25% in March 2022 all the way to 5.25% today. And the higher interest rates spilled into all other debt instruments in the market, including the U.S. Treasury.

How did this impact the crypto markets? Aside from triggering a painful crypto bear market, the rising yields also had a butterfly effect on stablecoins. If you recall, digital dollar issuers receive the USD deposits from their customers, but only holds a portion of them as actual cash. The rest are held in short-term government debt that are extremely liquid and generates yields.

During the zero-interest rate era, digital dollar issuers had to either be content with minimal net interest margin or take on additional risk to generate a meaningful yield on customer deposits. With higher rates, however, simply deploying funds into short-term U.S. government debt yielded annualized returns of ~5%, which generated sizable interest income for the industry giants like Tether and Circle.

In Q1 2024, Tether earned a record profit of $4.5 billion, $1 billion of which stemmed form operating profits derived from its U.S. Treasury holdings, which were about a third of J.P. Morgan Chase’s $13.5 billion. Considering Tether has less than 50 employees, compared to J.P. Morgan’s 250,000, you can conceptualize how profitable the digital dollar minting business is.

Digital dollar issuance has traditionally had high barriers to entry due to network effects and regulatory roadblocks. But these fat margins prompted other fintech and crypto players to enter the arena.

When I attended the Real World Asset (“RWA”) conference at ETH Denver, there were many projects that have either launched or were planning to launch their own digital dollars. Each of them were trying to figure out how to jump start their product and capture a portion of this lucrative market. I expect the competition to become more fierce as the rates continue to stay high.

(3) Product Differentiation

One problem with increasing competition is that there isn’t much differentiation between various digital dollar products. At the end of the day, they all represent a tokenized version of the USD that is minted and backed by the USD.

Issuers will argue their products are safer and more regulatory compliant vs. their competitors. This might have been true when Circle initially tried to differentiate itself from Tether, but given where the regulatory landscape is headed today, it only seems like a matter of time until stablecoin regulation becomes a thing.

And when that happens, digital dollar projects will have no choice but to adhere to these elevated standards (e.g., managing reserves, keeping & providing records, diversifying banking relationships, complying with AML/KYC regulations, etc.) . In other words, reliability can no longer be a differentiating factor.

Instead, I predict that digital dollar issuers will try to differentiate themselves through their “brand” and “network effect”.

Digital dollars are similar to credit card payment networks in that they essentially offer the same service, but only on different networks. To differentiate themselves, companies like VISA and MasterCard spend a lot of marketing dollars to maintain their brands. In the future, companies like Circle may also spend money on advertising, sponsorships, and promotion.

Another differentiating factor could be the network effect. Because digital dollar products are by and large not interoperable (more on this later), users naturally gravitate towards using existing products. One way for the issuers to maintain moat is by creating their own ecosystems and investing in applications that use their product.

Remember that revenue for digital dollar issuers = interest rate x user deposits. Since interest rate is set by the market, the only controllable variable is deposits (aka the volume of stablecoin in circulation). That’s why these issuers have every incentive to keep their products in circulation for longer.

I suspect this is Tether and Circle’s end game and why they are spending massive BD resources to support developers, onboard new exchanges, collaborate with L1s / L2s / DeFi projects, and invest in their ecosystem through in-house venture funds.

(4) Yield Sharing

Yields generated from user deposits are currently kept by the digital dollar issuers, but sharing them could be a way for new entrants to catch-up with the incumbents.

This could trigger stablecoin’s version of the DeFi yield game, where each project tries to out-bid another to gain market share. Profit margin will be eroded until it reaches an equilibrium, and seems like this is already happening in the market. Tether and Circle certainly won’t like this trend, and I can see them doubling down on marketing and network effect to protect their margins.

I acknowledge that there could be regulatory issues, so the centralized issuers might only share yields with their whitelisted users. That said, there is no doubt that yields will become a powerful customer acquisition tool in the stablecoin market.

(5) Cryptodollars: Increasing Off-chain Collateral

Let’s shift gears to cryptodollars.

We have already discussed how DAI maintains its peg against the USD. Due to the over-collateralization structure, however, it is harder to maintain the peg when DAI is trading above $1. Theoretically, you can arbitrage by buying ETH (or any other ERC-20 token that can be used as a collateral), locking it into the vault to mint more DAI, and selling it on the exchange for a profit.

The problem is MakerDAO will mint less than $1 of DAI for every $1 of ETH that is locked, which decreases the efficiency. And even if you sell the minted DAI, your ETH is still locked within the smart contract.

This asymmetry caused DAI’s price to rise to $1.04 in September 2020. Digital dollars like USDT and USDC don’t have this problem as their collateralization ratio is 100% (1:1 backed). Arbitrageurs also don’t need to worry about their USD getting locked as they are readily redeemable.

To solve this issue, MakerDAO introduced a Peg Stability Module (”PSM”) that allowed swapping of USDC and DAI at a 1:1 face value. The new mechanism ensured that the price of DAI and USDC can’t diverge much, but at the same time increased the amount of USDC that is backing DAI. This made DAI more susceptible to Circle’s control, which went against DAI’s raison d’etre of being a decentralized stablecoin.

PSM also pegged DAI to USDC, not the USD. The distinction may seem trivial, but this meant DAI’s price could be impacted if USDC (for whatever reason) were to de-peg from the USD. But many people dismissed the risk as USDC was considered to be the gold standard of transparency and trust. And like all things, it didn’t matter until it did.

When Silicon Valley Bank (”SVB”) suffered a bank run in March 2023, Circle had about $3.3 billion, or about 8% of the overall funds backing USDC, held in SVB. USDC holders rushed to redeem their money when the news broke, causing the digital dollar to de-peg from $1, which also impacted DAI’s price. Federal regulators ended up intervening to make all the depositors whole, which also bailed out both USDC and DAI. The irony.

Crisis was averted, but it served as a good reminder that DAI’s dependence on USDC introduced additional risks and MakerDAO sought ways to reduce their exposure to USDC. One solution was to replace them with RWA collateral like the U.S. Treasury.

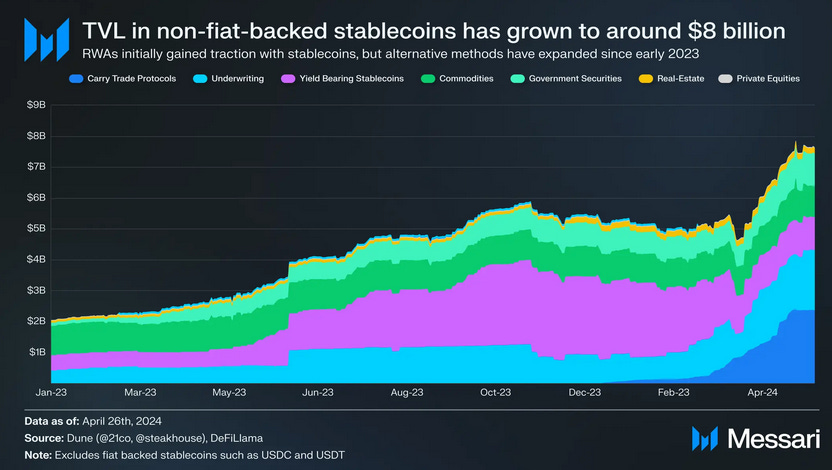

Throughout crypto’s short history, there have been various attempts to tokenize RWAs. But many struggled to to gain traction and ultimately failed to get off the ground. The catalyst finally came in 2022-2023 when the the Fed fund rate went up to 5.25% and U.S. Treasury offered better yields than the DeFi native protocols offering ~3% on their stablecoins.

By embracing RWAs, MakerDAO was not only able to diversify its reserve, but also offset its declining revenue streams at the time. Because RWA collateral was less volatile than the crypto alternatives, they allowed MakerDAO to continue to lend and earn fees during the crypto bear market. RWAs also enabled MakerDAO to tap into a multi trillion-dollar industry that was isolated from crypto.

Figure 5: TVL in non-fiat-backed stablecoins (excluding USDT and USDC).

Source: Messari, Dune, Defi Llama

The new macroeconomic conditions led to the rise of protocols that brought these off-chain yields on-chain. In the chart above, you can see the rapidly growing TVL in RWA protocols (excluding digital dollars) which has increased from approximately $2 billion at the beginning of 2023 to nearly $8 billion in April 2024.

These DeFi protocols generate profit by arbitraging the spread between the yield opportunities it seeks and the yield paid to the users. As competition ramps up, there will be pressure to pass on higher yields to the users, which can be mitigated by either (i) seeking higher yielding assets or (ii) increasing the volume.

These dynamics will push the protocols to include a higher percentage of RWAs in their collateral and also force them to broaden the collateral base by including more volatile and less-liquid assets that provide higher risk premium.

04. Issues with Existing Stablecoin Products

We already discussed how digital dollars are a superior form of USD that offer many benefits.

But these digital dollars don’t fundamentally change the way we transact as they are just new front-ends that offer better UX while using the same TradFi back-ends. For example, all the USD reserves are still held at various depository banks and therefore are subject to the same credit and regulatory risks.

They are certainly an upgrade over our antiquated banking infrastructure, but there are still issues that prevent the existing digital dollar products from realizing their full potential.

(1) Fragmentation

Figure 6: Digital dollars (excluding cryptodollars) by market capitalization.

Source: Defi Llama

As tracked by DeFi Llama, there are currently 22 live versions of digital dollars. The market is still dominated by the big 2, but the rising interest rates and increasing margins are attracting new players to issue their own products.

These digital dollars all represent the same tokenized version of the USD, but are not inter-operable. Put it another way, there isn’t an easy way for a user holding USDT to make payments to a merchant that only accepts USDC even though they both represent the dollar. Yes, you could swap USDT to USDC at any one of the major exchanges, but that is “trading” and adds friction to the transaction.

This lack of inter-operability is inconvenient for the users, but the existing issuers have little incentive to solve the issue as maintaining their moat is the only way to keep the margins high. Maybe we will see some consolidation in the future through a combination of regulatory crackdowns and the bear market, but the incumbents are motivated to maintain status quo and keep the users behind their walled gardens.

(2) Inefficiency

Lack of inter-operability presents other challenges. Because each digital dollar has its own ecosystem, stablecoin app developers have to integrate their products with each platform. Imagine having to integrate your API with not just iOS and Android, but 20 other operating systems.

There is also a lot of time and money wasted on BD efforts as each ecosystem seeks to attract its own applications and trading liquidity. It’s not dissimilar to the ICO mania that swept the industry back in 2016-2018 when every “d-app” (talk about marking of time) launched its own L1.

By doing this, not only did they have to bootstrap their own network, but also commit resources to secure the chain and run the nodes. This seems crazy in hindsight as every project now launches their own tokens on top of existing L1s (or even L2s).

The same can be said of the existing digital dollar landscape as each issuer is not only creating their own products, but also ensuring regulatory compliance, developing relationships with depository banks, managing their own reserves, and spending resources to attract liquidity and maintain their moat. The entire system seems very inefficient.

(3) Centralization

The digital dollar model also goes against decentralization, arguably one of the core principles of crypto. Even if you don’t care about the philosophy, centralized issuers dominating the market introduces additional risks. The first is credit risk. A single entity issuing all digital dollars may offer better short-term utility, but as we’ve witnessed during the SVB crisis, it presents a single point of failure.

The second is regulatory risk. Circle is currently considered the golden standard of the industry, but the tide can turn against them if the SEC or the Department Treasury changes their stance on USDC. These centralized issuers are easier to shutdown than the decentralized ones as regulators can simply prevent the banks from serving them (aka “Operation Chokepoint”).

Circle and other centralized issuers are fighting the good fight and collaborating with law makers for regulatory clarity (e.g., Lummis-Gillibrand Payment Stablecoin Act), but single point of failure will always exist in the digital dollar model.

(4) User Benefit

Whether it’s for regulatory or financial reasons, digital dollar issuers currently accumulate all the profit generated from user deposits. There is a mismatch between those who are driving value creation (users, apps, DeFi, and exchanges) vs. those who are capturing the upside (issuers).

As competition ramps up, I expect newer players to aggressively share yields with their users to grow market share. But even so, the users are still at the mercy of these centralized issuers that could change their policy at anytime.

What about cryptodollars?

Cryptodollars like DAI solve many problems associated with digital dollars, but they aren’t dominating the stablecoin market due to their own limitations.

The biggest issue is their over-collateralization model. Cryptodollars require a lower capital efficiency to hedge the protocols against the volatile crypto collateral, which will always put them at a structural disadvantage vs. their centralized counterparts.

But what if there are cryptodollars that are 100% backed by more stable RWA collateral like the U.S. Treasury? In fact, Ondo Finance launched a cryptodollar that wraps U.S. Treasury ETF and passes the yield to its holders. This improves the capital efficiency, but Ondo’s KYC restrictions, which I presume were necessary to launch this product in the U.S., render them unusable to the average crypto investor.

Cryptodollar products are also quickly evolving and including a wider variety of collateral like the liquid staking token (”LST”) backed stablecoins as well as “cash and carry” models like Ethena’s USDe. I’m not as well versed in these newer products, but I expect them to have more difficulty gaining adoption from average retail and institutional investors due to their structural complexity.

05. A Case for a Decentralized Stablecoin Infrastructure

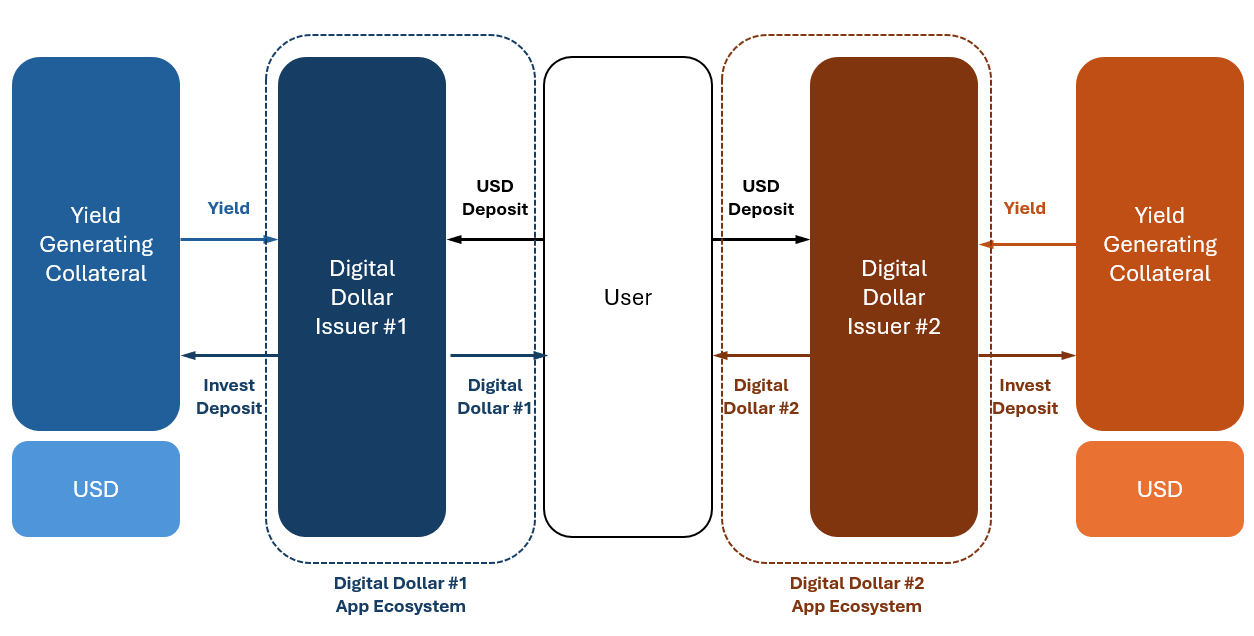

Figure 7: Simplified diagram of the existing digital dollar market.

Source: Me

As it stands, the digital dollar market looks like the simplified diagram above. Centralized, fragmented, not inter-operable, and full of inefficiency.

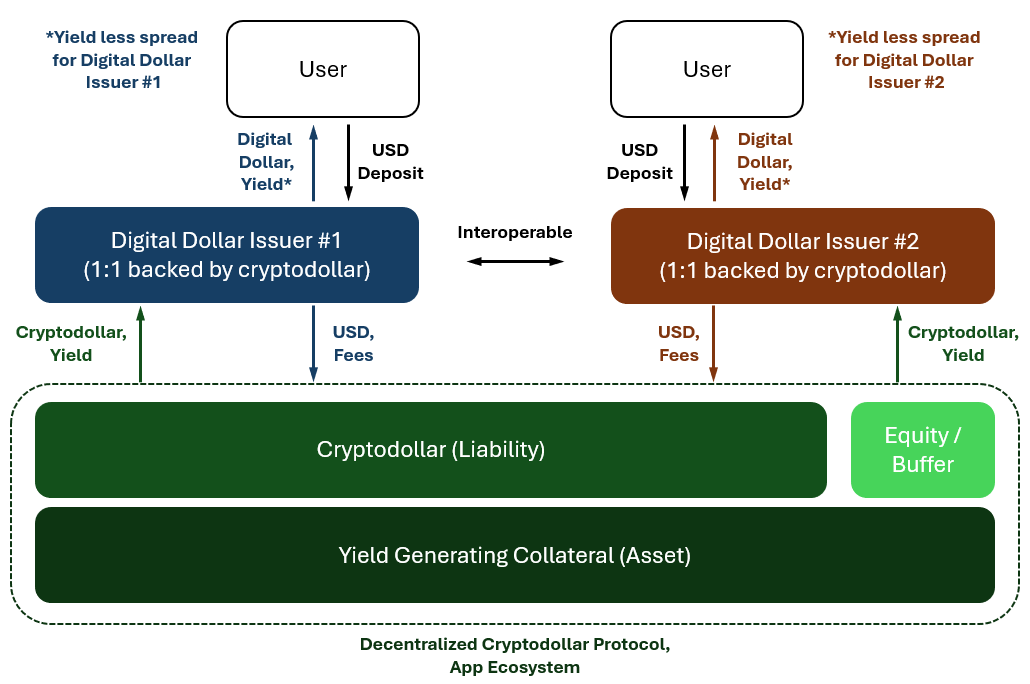

But what if we could create an infrastructure layer below the existing digital dollar front-ends? Wouldn’t it combine the best of both digital dollars and cryptodollars?

The new decentralized infrastructure can use T-bills as collateral to mint new cryptodollars in a permissionless manner. And existing digital dollar issuers can leverage these new cryptodollars to create their own USD tokens.

This infrastructure layer will only take some fees and pass the underlying yields to the digital dollar issuers and even users directly if they desired to participate. Every digital dollar will be interoperable as they all share the same cryptodollar infrastructure, and developers won’t have to worry about integrating with 22 versions of the USD.

Figure 8: Hypothetical diagram of a new digital dollar market using a shared decentralized cryptodollar protocol.

Source: Me

As Packy McCormick said in his post, “money which was thought of as an application can perhaps now become an infrastructure upon new front-ends can be built”. There is actually a project that is working on a similar idea, which I find very fascinating. I hope to dive deeper into this concept in my future post.

Useful Resource:

Coinbase Institute: Stablecoins White Paper

Packy McCormick: Circle & USDC: Building a Stable Platform

Liam Horne: Making Sense of Tether on Tron

Polynya: A Brief History of Crypto